As the cost of healthcare continues to rise in the United States, so too does the amount of out-of-pocket expenses Americans must pay to access basic care in their communities. According to data compiled by the American Medical Associate (AMA), the cost of healthcare spending rose to 9.7% in 2020, resulting in an expenditure of $4.3 trillion, or roughly $12, 530 per capita. A report from the CMS Office of the Actuary predicts out-of-pocket expenses for Americans will continue to rise approximately 4.6% each year from 2022 to 2030. With cost already a burden to many Americans, what can we do to save money while still getting the most from our benefits and meeting our healthcare needs? Let’s explore six ways you can lower your healthcare spending.

Avoid Emergency Rooms for Non-Emergencies

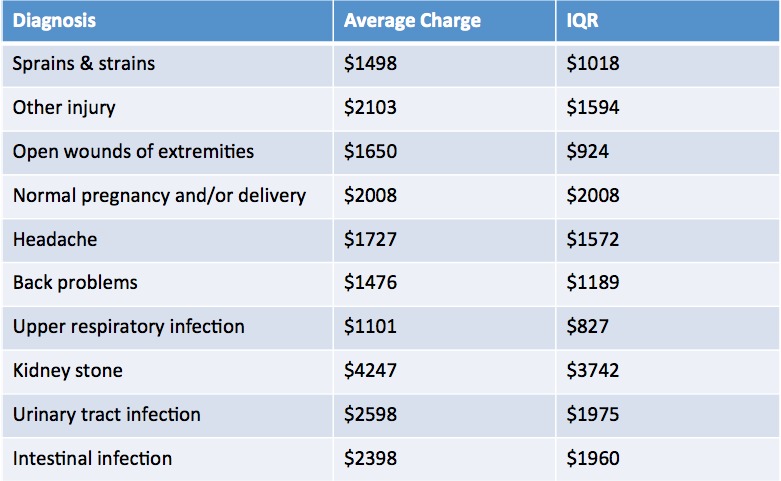

Research conducted by the UnitedHealth Group found that 18 million out of 27 million visits to the Emergency Department (ED) each year are unnecessary. One third of visits to the ED are not classified as actual emergencies and are easily treatable with a primary care visit. These types of non-emergencies include bronchitis, nausea, allergies, dizziness, cough, strep throat, headaches, back pain, and other common ailments. The cost of going to the ED for a primary care ailment is an estimated $2,032 per trip. That’s 10x the cost of visiting urgent care ($193) and 12x the cost of seeing your primary care physician ($167).

On the surface, it’s better to be safe than sorry when it comes to one’s own health but knowing when to seek emergent care and what types of ailments are considered emergent is important. If unsure whether your symptoms are treatable by primary care or need emergency assistance, reach out to your physician’s office, or speak with a nurse through your insurance company. Tedious as it might be, it could be the difference between a few hundred dollars or a few thousand dollars.

Develop a Good Relationship with Your Primary Care Physician

According to a study conducted by the JAMA Internal Medicine, the number of Americans with a Primary Care Physician (also known as a PCP) is declining. This is due to several factors: shortage of PCPs and an emerging “convenience culture” that encourages ED visits, urgent care centers, and walk-in clinics with non-traditional hours. That said, the study found that establishing a long-term relationship with a PCP is the most cost-effective measures Americans can take.

A primary care physician is a medical professional who is most intimately aware of your circumstances, medical history, and overall health. This is because the role of a primary care physician is to provide everyday care, from preventive and routine wellness visits to treatment of common conditions. The idea is that by seeing the same doctor, medical issues are caught and treated before they become emergencies or need specialist care. A stranger at the ED is less likely to know your medical status, which makes visits to urgent and emergency care centers more expensive. Thus, by seeing a PCP, out-of-pocket expenses would remain lower for Americans.

Use Benefits to their Fullest

We hear all the time that prevention is the key to lasting health, but it’s also a means of keeping our wallets fatter and happier. When it comes to healthcare benefits, prevention begins with knowing the value of services they cover and making the most out of those services at the optimal times. A few examples of ways to use lesser-known benefits to your financial advantage:

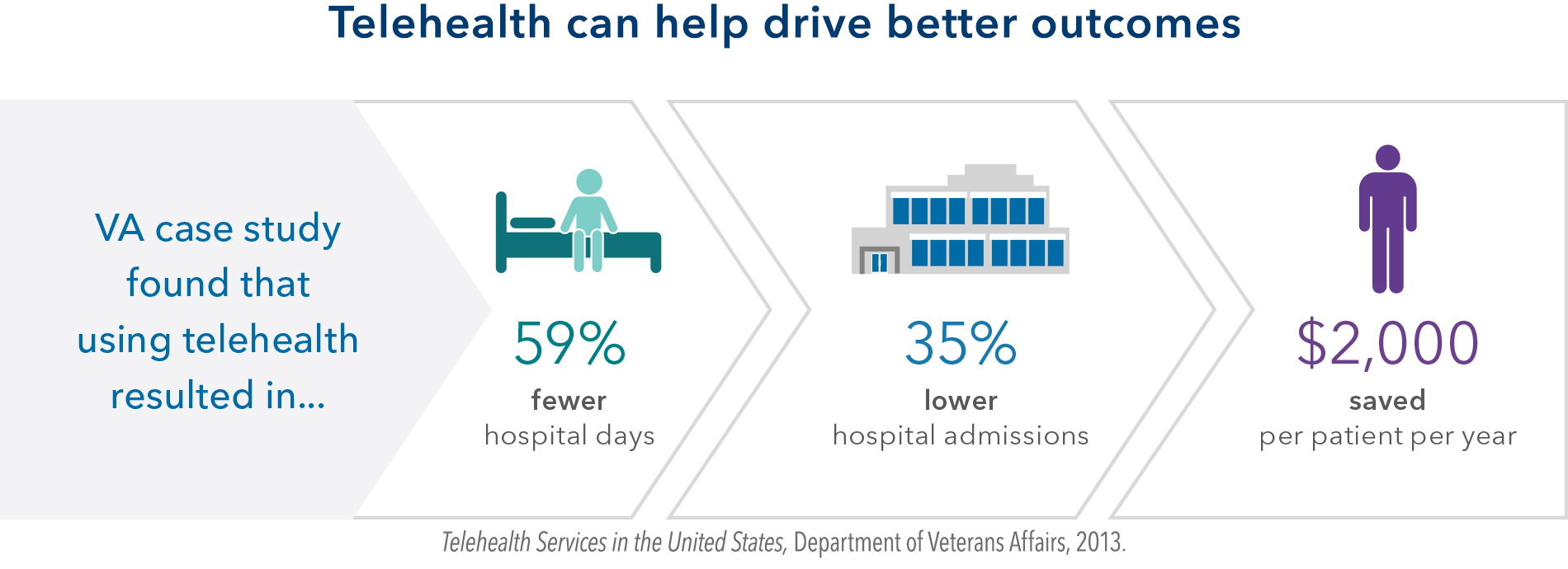

- Opt for a Telemedicine visit instead of an In-Office visit – virtual care is a fraction of the cost and can be as effective as an In-Office visit for common medical concerns ($30-$50 per visit $135-$175 per visit). If your PCP requests a visit for a minor health concern, request that it be addressed online, either by email, phone, or a virtual visit. If they provide a service portal for their patients, this option should be available to you.

- Get routine Preventive/Wellness exams and screenings each year – Routine check-ins with your physician for preventive care will lower the chances of health surprises later in life or the need for complicated treatments. But if health concerns do arise, your physician is more than prepared to address them as they often come at a much cheaper cost when found early on. However, ongoing studies show only 8% of Americans with insurance use preventive care services. Many, in fact, simply visit their doctor for diagnostic care or an ED when a medical issue arises, which is significantly more expensive. The Affordable Care Act regulations require compliant health insurances cover wellness and preventive services at 100%. These services, determined at minimum by the US Preventive Services Task Force grade A & B recommendations, include yearly wellness exams, general medical labs, vitals screenings, diabetes screenings, vaccinations, WellBaby visits, and more. Check with your insurance carrier for a list of preventive services they cover.

- Use the Nurse Hotline – Some Primary Care providers and insurance companies might have a 24/7 Nurse Hotline. This is a service where nurses, nurse practitioners, or other qualified providers are available to speak with you over the phone to help determine what type of care you need. In some cases, they have access to a telemedicine portal that allows them to communicate with a physician regarding your condition and provide you with treatment recommendations over the phone. Often at little to no cost to you! This saves you time and money by avoiding unnecessary in-office, emergency, and urgent care visits.

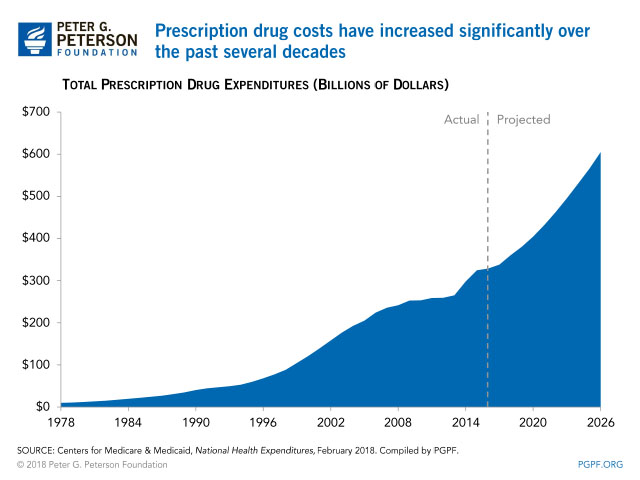

Reduce the Cost of Prescription Drugs

One of the lesser-known ways of reducing the cost of treatment is by switching to generic drugs instead of their brand-name variants. According to the Food and Drug Administration (FDA), generic drugs can cost 70% less, even though they have the same active ingredients as their brand-name versions. While it’s important to note that not all brand-name drugs have a generic option, it’s still worth speaking to your physician and pharmacist about your medication cost needs. In many cases, if no generic drug is available, they will work with you to prescribe a more affordable option. It’s also worth investigating whether your insurance company, local pharmacy, or the specific drug manufacturer offer prescription drug programs, as these can also help curb the costs of medication.

Advocate for Yourself

When it comes to your health, no one is a better advocate for you than yourself. But being an advocate is more than seeking and receiving care when you need it; it’s also speaking up when you don’t understand a diagnosis or need to know the ins and outs of a treatment. There will be times when you’ll need to dispute incorrect charges, challenge the necessity for certain types of treatment or tests, and discuss the removal of medications that no longer work. Although the idea of digging your heels in when it comes to your healthcare might be uncomfortable, it can save you shocking and unnecessary bills later down the line.

Prioritize Personal Health

Alongside preventive care, the first line of defense against burgeoning out-of-pocket costs is to maintain your overall health the best you can with simple and healthy everyday choices. Staying hydrated, sneaking in a few vegetables with each meal, prioritizing sleep, and getting some form of exercise a day—taking your dog for a walk, using the stairs, yoga, playing outdoor games with your children—can make a huge difference in your health.

While bad habits might not appear all that terrible right now, studies show they have lasting and detrimental impacts on one’s health. You don’t have to get rid of all of them but making a few life changes now can save you money and precious time later.

Reducing healthcare costs takes work and knowing your resources. Be sure to take a close look at your current health plan, the coverage you get (vs what you actually use or need), and what it is costing you each year to determine if switching plans could help you – and your wallet!

Additional References:

Here’s how much the average American spends on health care (cnbc.com)

Trends in health care spending | Healthcare costs in the US | AMA (ama-assn.org)

How Americans spend much more on health care than they realize | PBS NewsHour

How much will the US spend on health care over the next decade? (advisory.com)

The High Cost of Avoidable Hospital Emergency Department Visits – UnitedHealth Group

https://jamanetwork.com/journals/jamainternalmedicine/fullarticle/2757495