Top 4 Life Insurance Trends Shaping the Market in 2025

September marks the 20th anniversary of Life Insurance Awareness Month—an ideal time for Americans to review their company’s life benefits. With open enrollment approaching, employers should assess whether current benefit options meet the evolving needs of today’s workforce.

Staying updated on life insurance trends helps employers remain competitive and attract top talent in a fast-changing hiring market. Below are four key life insurance trends to consider when refining your benefit strategies this season.

Here are four life insurance trends to consider including in your benefit strategies!

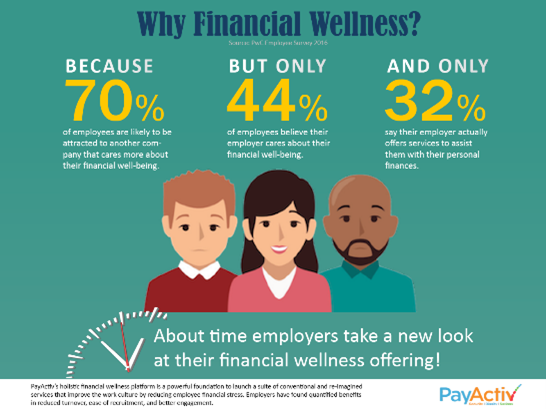

Insurers Shifting Toward Financial Wellness Focus.

When the COVID-19 pandemic hit, it made major waves in the insurance market as employees shifted towards prioritizing financial wellness and pursuing opportunities that enrich their personal lives. According to the Wellness Barometer Survey conducted by Forbes in 2022, 72% of employees worried about their finances—before, during, and after the pandemic—and the impact they have on their physical and mental health.

This is a worry that doesn’t appear to be going away anytime soon, with rising debt, burgeoning inflation, and employment uncertainty. Now, more than ever, Americans want a sense of safety and certainty for the future. Insurers and employers alike are increasingly on the hunt for benefits to meet these needs.

Notable financial wellness benefits on the rise include: (1) debt repayment programs (2) retirement planning (3) financial advising (4) professional development with financial incentives (5) external investment solutions. And high on this list of financial benefits? Flexible life insurance options.

Value Add Coverage Is Highly Competitive—and Desirable.

A key area of focus for insurers and brokers this year has been an emphasis on value-add products that can be purchased online at anytime from anywhere.

As customer expectations continue to rise—and their desire for coverage they can customize rapidly expands—brokers and insurers that offer additional micro-products alongside their primary coverage options will draw the attention of and appeal more to multi-generational customers across all demographics.

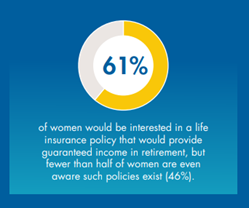

“61% of women would be interested in a life insurance policy that would provide guaranteed income in retirement, but fewer than half of women (46%) are even aware such policies exist.”

A 2022 CapGemini report shows value-add benefits like dental, vision, wellness, and identity protection continue gaining popularity in 2023. As personalized coverage becomes more important, life insurance trends follow suit with growing demand for value-add Riders offering expanded protection.

These Riders include terminal illness benefits, premium waivers for disability, paid-up additions, and child life insurance in case of tragedy. This trend creates new opportunities for insurers and brokers aiming to serve underrepresented groups like women, Gen Z, and low-income households.

Women Want More Life Insurance Options.

LIMRA studies show many women want life insurance in 2023 but often overestimate costs or lack policy knowledge. Although women share equal concerns with men about funeral costs and family security, they remain less likely to own coverage.

Only 49% of women hold life insurance compared to 54% of men, leaving 54 million American women uninsured. This growing coverage gap presents a major opportunity for the life insurance industry to better serve women, including mothers and caregivers.

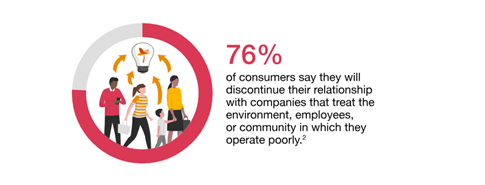

Consumers Want to See Insurer ESG Initiatives.

Environmental, social, and governance (ESG) initiatives continue to trend across generations as a focal interest to consumers in 2023, providing a strategic challenge with the potential for growth in the life insurance market. With community concerns surrounding environmental events, ranging from natural disasters to agricultural regulations, consumers are seeking to invest in insurers whose values align with their own.

But it’s more than that. Consumers want to see that insurers are invested in shaping a better future for their communities and loved ones. This includes actionable steps to be more environmentally friendly, make workplaces more inclusive and fairer, and adopt accessible language to make their policies more easily understood. In summary: consumers want insurers (and employers) who appreciate and contribute to their lives.

Stay On Trend with Enrollment First!

With competitive life insurance products and cutting edge, yet user-friendly technology, Enrollment First can help brokers and employers stay on trend with ever-evolving benefit options.

To get started, call us at (866) 951-8404 or fill out this form to have a representative reach out about our upcoming life insurance options.

The above content is purely informational and is not comprehensive.

Want to stay informed about industry news and resources? Read more on our blog!

Follow us on social media!

Sources:

https://www.forbes.com/advisor/life-insurance/life-insurance-statistics/

https://www.docusign.com/blog/insurance-trends-watch

https://www.plansponsor.com/as-delta-concerns-grow-workforces-are-rethinking-open-enrollment/

https://www.pwc.com/us/en/industries/financial-services/library/next-in-insurance-top-issues/esg-insurance-industry.html

https://www.forbes.com/sites/forbesfinancecouncil/2023/02/02/financial-wellness-in-2023-how-to-support-your-employees-during-economic-uncertainty/?sh=5597da2227e7

https://money.usnews.com/financial-advisors/articles/financial-advising-trends-this-year

https://www.pwc.com/us/en/services/consulting/business-transformation/library/employee-financial-wellness-survey.html

https://medium.com/birds-view/embedded-insurance-why-will-it-matter-more-in-2023-95eb42ad4db9

¹ 2023 Insurance Barometer Study, LIMRA and Life Happens; 2023 Gender, Generation, Wellness, and Stress, LIMRA; 2023 Labor Force