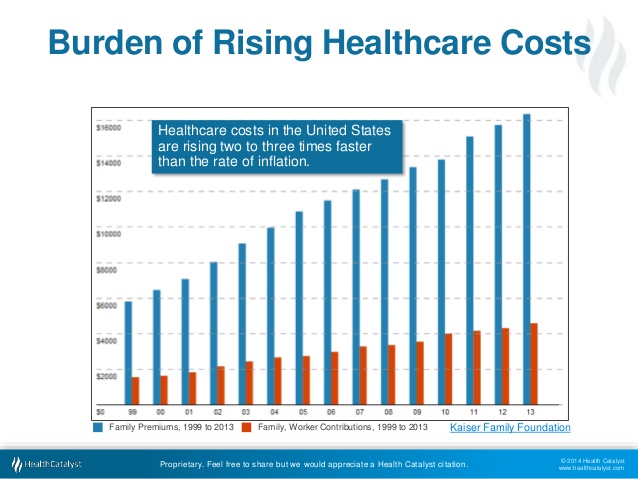

According to the Kaiser Family Foundation, health insurance spending in the United States in 2021 was the highest it has ever been. The overall costs ranged from $7,739 for individuals and $22,221 for families. As inflation continues to hit the healthcare market, these costs are expected to rise another 6.5% in 2022.

This ambiguity and instability of traditional healthcare plans have led employers to seek out affordable alternative insurance options that cover more services for a fraction of the cost. Reference-based pricing (RBP) is one such option that is gaining in popularity with its ability to reduce healthcare spending by 30%.

What Is Reference- Based Pricing?

Reference-based pricing is a health plan strategy that cuts out the middleman (insurance companies) by giving the power back to employers to set prices for medical services based on Medicare+ rates. With traditional healthcare plans, providers negotiate with insurance companies to decide what portion of medical services are covered by whom. From there, the insurance covers a certain amount; the rest is billed (by the provider) to the employee. By cutting out the middleman and working directly with providers, RBP simplifies the process of getting medical services covered without many of the obstacles traditional healthcare plans pose.

How Is It Re-shaping the Health Insurance Market?

To better understand how reference-based pricing is revolutionizing the current market, it’s important to acknowledge the gaps in healthcare needs and focus on how it addresses them:

- Freedom of choice – removes the in-network/out-of-network system, which gives employees the ability to choose any provider that best fits their needs.

- Complete transparency – RBP provides the actual cost of treatment prior to medical services rendered. This also makes it easier to plan medical care and budget for procedures in advance.

- Provider competition and accountability: increase as patients choose doctors based on performance metrics, not restricted networks, regaining control and choice.

- Equitable & stable during times of rising costs: – There is no high deductible, costly premium, or sudden hidden fees to tackle when it comes to medical care. Because RBP uses Medicare+ cost trends as a reference, the amount you pay is considerably less and much more predictable than traditional healthcare plans no matter the provider.

Reference-based pricing closes financial and knowledge gaps that traditional healthcare plans often ignore, offering a more transparent alternative. However, today’s rising inflation and economic uncertainty push many employees to forgo coverage rather than pay high insurance premiums. As a result, unexpected medical needs can leave them exposed to overwhelming and unaffordable healthcare costs.

However, RBP gives those employees a peace of mind, and a steady foundation of transparency and stable spending to plan their healthcare on. It gives them the freedom to choose a better plan for themselves, and thus, the ability to live better lives without the worry of coverage.

Sources:

What Is Reference Based Pricing? | KBI Benefits

Reference-Based Pricing: Is It Right for Your Organization? (usi.com)

EBA: A How-To Guide For Reference-Based Pricing – DirectPath | DirectPath (directpathhealth.com)