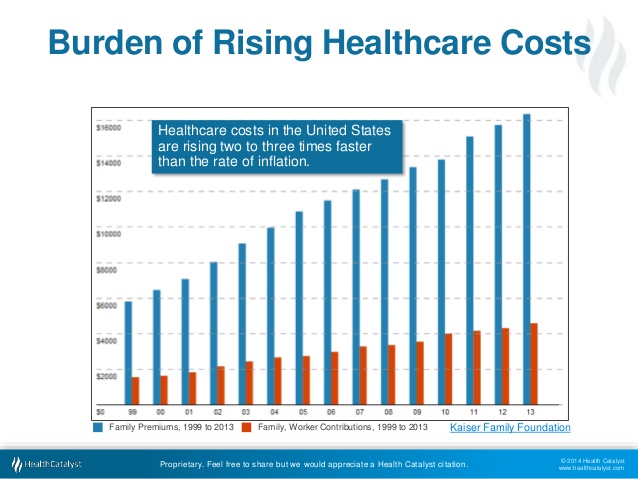

According to the Kaiser Family Foundation, health insurance spending in the United States in 2021 was the highest it has ever been. The overall costs ranged from $7,739 for individuals and $22,221 for families. As inflation continues to hit the healthcare market, these costs are expected to rise another 6.5% in 2022.

This ambiguity and instability of traditional healthcare plans have led employers to seek out affordable alternative insurance options that cover more services for a fraction of the cost. Reference-based pricing (RBP) is one such option that is gaining in popularity with its ability to reduce healthcare spending by 30%.

What Is Reference- Based Pricing?

Reference-based pricing is a health plan strategy that cuts out the middleman (insurance companies) by giving the power back to employers to set prices for medical services based on Medicare+ rates. With traditional healthcare plans, providers negotiate with insurance companies to decide what portion of medical services are covered by whom. From there, the insurance covers a certain amount; the rest is billed (by the provider) to the employee. By cutting out the middleman and working directly with providers, RBP simplifies the process of getting medical services covered without many of the obstacles traditional healthcare plans pose.

How Is It Re-shaping the Health Insurance Market?

How Is It Re-shaping the Health Insurance Market?

To better understand how reference-based pricing is revolutionizing the current market, it’s important to acknowledge the gaps in healthcare needs and focus on how it addresses them:

- Freedom of choice – removes the in-network/out-of-network system, which gives employees the ability to choose any provider that best fits their needs.

- Provider competition & accountability – Because there is no in-network/out-of-network system providing medical professionals guaranteed patients, power is given back to the patient to choose their provider based on performance and data metrics relevant to them.

- Complete transparency – RBP provides the actual cost of treatment prior to medical services rendered. This also makes it easier to plan medical care and budget for procedures in advance.

- Equitable & stable during times of rising costs: – There is no high deductible, costly premium, or sudden hidden fees to tackle when it comes to medical care. Because RBP uses Medicare+ cost trends as a reference, the amount you pay is considerably less and much more predictable than traditional healthcare plans no matter the provider.

In essence, reference-based pricing fills in financial and knowledge gaps that have long-since existed with traditional healthcare plans. The world is brimming with uncertainty and crushing inflation, most of which often leaves employees choosing no insurance over costly plans. And if significant healthcare needs strike, it leaves them vulnerable to impossible healthcare costs.

However, RBP gives those employees a peace of mind, and a steady foundation of transparency and stable spending to plan their healthcare on. It gives them the freedom to choose a better plan for themselves, and thus, the ability to live better lives without the worry of coverage.

Sources:

What Is Reference Based Pricing? | KBI Benefits

Reference-Based Pricing: Is It Right for Your Organization? (usi.com)

EBA: A How-To Guide For Reference-Based Pricing – DirectPath | DirectPath (directpathhealth.com)