Smart Strategies to Cut Healthcare Costs Without Compromising Your Health

Healthcare costs keep rising in the U.S., forcing Americans to pay more out-of-pocket just to access essential care locally. The American Medical Association (https://www.ama-assn.org/system/files/prp-annual-spending-2020.pdf) reported a 9.7% increase in healthcare spending in 2020, totaling $4.3 trillion—or $12,530 per person. Looking ahead, CMS (https://www.advisory.com/daily-briefing/2022/03/29/health-care-spending) predicts out-of-pocket costs will grow by 4.6% annually from 2022 through 2030. As expenses climb, many Americans struggle to balance healthcare needs with limited budgets. So how can you lower costs while maximizing benefits? Let’s explore six practical ways to reduce your healthcare spending without sacrificing necessary care.

Avoid Emergency Rooms for Non-Emergencies

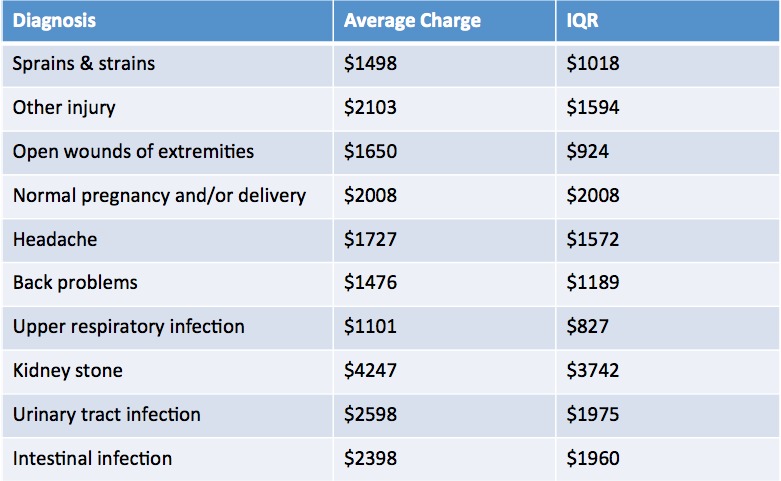

UnitedHealth Group found 18 million of 27 million annual emergency room visits are unnecessary and avoidable with proper care. About one-third of ER visits involve non-emergencies that primary care doctors can treat quickly and affordably. These non-emergent issues include nausea, cough, dizziness, allergies, bronchitis, strep throat, headaches, and minor back pain.

An ER visit for a common illness costs $2,032—ten times more than urgent care and twelve times more than primary care. While safety matters, understanding when to use emergency services helps you avoid excessive medical bills. If unsure where to go, contact your doctor’s office or speak with a nurse through your insurance provider. This quick step could save you thousands while still getting the care you need.

Average cost of Emergency Room Services – Source: The Atlantic

Build a Strong Relationship with Your Primary Care Physician

A JAMA Internal Medicine study found fewer Americans now have a primary care physician (PCP), and the number keeps dropping. This decline results from PCP shortages and a growing “convenience culture” favoring urgent care clinics and walk-in services with flexible hours. However, researchers found that maintaining a long-term PCP relationship remains one of the most cost-effective choices for your health.

Your PCP understands your full medical history and personal health circumstances, unlike unfamiliar providers in walk-in or emergency settings. They offer routine care, preventive screenings, and early treatment—preventing issues before they become emergencies or require specialist intervention. Because of this continuity, patients with a regular PCP often face fewer medical surprises and lower healthcare expenses.

Maximize the Value of Your Health Benefits

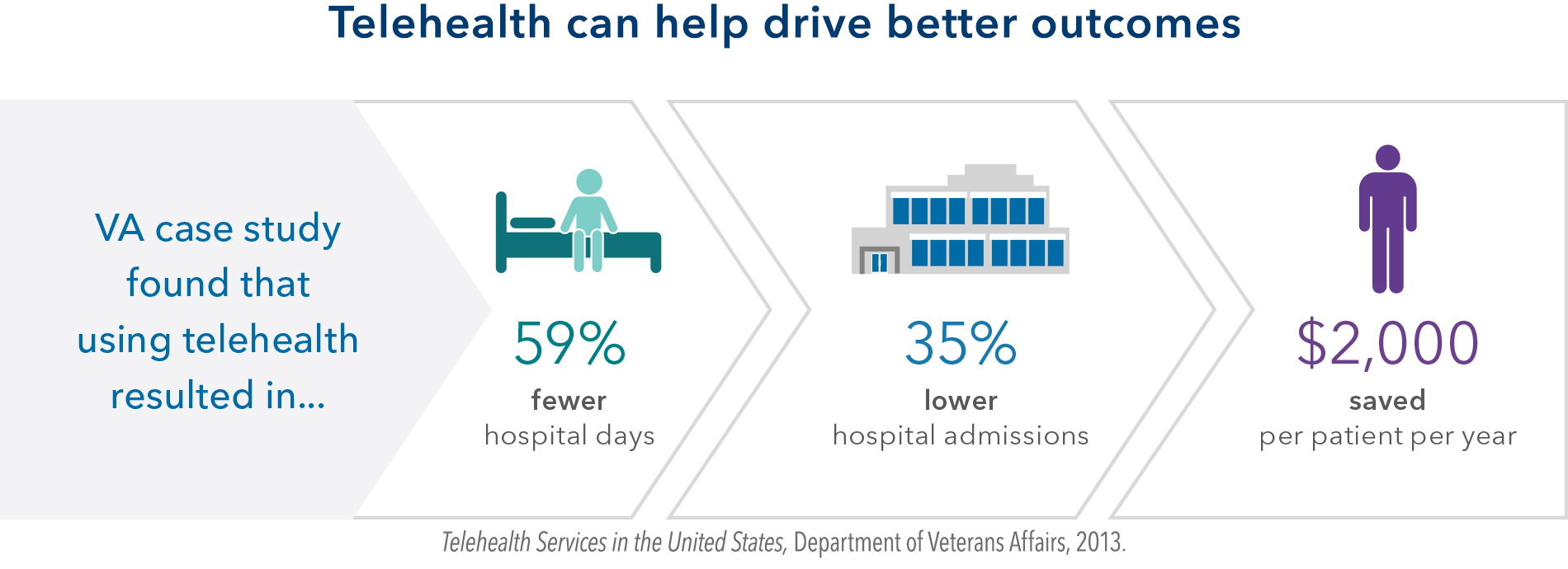

Preventive care improves long-term health and helps reduce your total out-of-pocket medical costs. To save money, start by learning what your healthcare plan covers and when to use each benefit effectively. For example, choose telemedicine instead of in-person visits whenever possible—it’s often cheaper and just as effective for common issues.

A virtual visit typically costs $30–$50, while in-office appointments average $135–$175 per visit. Ask your doctor to handle minor concerns online via email, phone call, or their secure patient portal. If your provider offers virtual services, take advantage of them to save time and reduce unnecessary expenses.

Schedule Preventive Exams and Screenings Every Year

Annual wellness exams help your doctor detect issues early, reducing long-term costs and the need for complex treatments. When problems arise, your doctor can act quickly, often at a lower cost than late-stage or emergency care. Still, studies show only 8% of insured Americans use preventive services, despite the Affordable Care Act covering them at 100%. Instead, many wait until problems require expensive emergency or diagnostic care, increasing personal and system-wide healthcare costs. Take advantage of covered services like physicals, lab work, diabetes screenings, vaccines, and WellBaby visits. To avoid surprises, check with your insurance provider for a full list of included preventive services.

Use 24/7 Nurse Hotlines When Available

Many providers and insurance companies offer free Nurse Hotlines staffed by licensed nurses and other qualified professionals. You can call to describe your symptoms and get professional advice about whether you need in-person care or can wait. Often, they consult physicians and provide recommendations through telemedicine—saving time, stress, and unnecessary urgent care expenses. Best of all, Nurse Hotlines typically come at no additional cost, making them a smart first step for basic concerns.

Cut Prescription Drug Costs

Switching to generic medications can save you up to 70%, according to the FDA, without sacrificing effectiveness or safety. Generics contain the same active ingredients and often treat conditions just as well as their brand-name counterparts. If no generic exists, talk with your doctor or pharmacist about cheaper alternatives that fit your medical and financial needs. Also, check whether your insurance, pharmacy, or drug manufacturer offers discount programs to help reduce medication expenses.

Speak Up and Advocate for Your Care

You know your health best, so don’t hesitate to ask questions or challenge unclear or unnecessary treatments. Request clarification if you don’t understand a diagnosis or treatment plan—it could save you confusion and unexpected costs later. If billing errors appear, dispute them promptly and ask for detailed breakdowns of questionable charges. When medications no longer work or seem excessive, ask your doctor whether it’s time to adjust or eliminate them. Advocating for yourself takes effort but often prevents high out-of-pocket expenses and confusion.

Make Healthy Habits a Daily Priority

Prevention starts at home, so aim to stay hydrated, eat more vegetables, and get regular sleep and movement each day. Simple actions like walking your dog, using stairs, or stretching can improve your health and lower medical costs long-term. Even minor lifestyle changes—like cutting back on processed food or increasing sleep—reduce future healthcare visits and expenses. While bad habits may seem harmless now, research links them to serious health issues and high future medical bills.

You don’t need to overhaul everything at once—start small and focus on consistency.

Know Your Plan and Reevaluate Each Year

Reducing healthcare costs starts with understanding your current health plan and what it truly covers. Compare your plan’s annual costs against what you actually use to determine if a switch might benefit your budget. Use open enrollment periods to assess other plan options, especially if your current plan doesn’t meet your changing needs. Knowing your benefits, using available resources, and prioritizing your health will help you save money without sacrificing care.

Additional References:

Here’s how much the average American spends on health care (cnbc.com)

Trends in health care spending | Healthcare costs in the US | AMA (ama-assn.org)

How Americans spend much more on health care than they realize | PBS NewsHour

How much will the US spend on health care over the next decade? (advisory.com)

The High Cost of Avoidable Hospital Emergency Department Visits – UnitedHealth Group