20

Years of

Experience

About

Enrollment First

Enrollment First helps eliminate the headache of benefits administration by combining affordable coverage with a sophisticated enrollment platform. In addition, our advanced reporting tools, 24/7 benefits access, and dedicated in-house Service Center work together to ensure participants have every resource they need to confidently understand and use their benefits.

🔗 Read More ➤

Call Us Today!

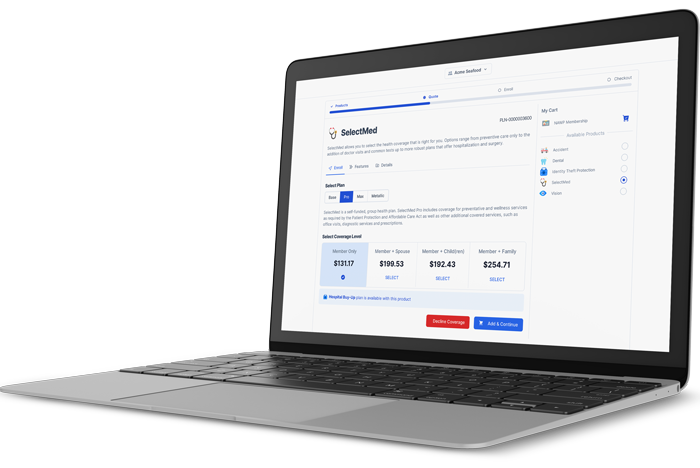

OUR eConnect

Enrollment Technology

Our proprietary eConnect technology provides:

- 24/7 access to benefits information for participants

- Fast, self-service enrollment in minutes

- An employer portal with advanced reporting to manage health spending

Additional platform highlights:

- Seamless integration with client and partner systems

- Setup and load time under 30 minutes

- Real-time tracking of contributions, deduction reports, and more

00

+Groups

00

+Brokers

00

+Members

Industries We Serve

Enrollment First began in 2002 with a clear mission: to provide competitive, accessible benefits to independent contractors in the transportation industry. What started with a single call center team has since expanded into a nationwide platform supporting individuals, small businesses, and large organizations across a wide range of sectors.

Today, we deliver tailored workplace solutions designed to meet the evolving needs of diverse workforces—whether 1099, W-2, or gig-based—helping teams stay protected, informed, and confident in their benefits.

Products We Offer

• National “A” Rated insurance carriers

• Group underwriting & rates as low as 2 lives

• Guaranteed Issue products

• Fully ACA-compliant medical coverage options

At Enrollment First, we partner with nationally rated “A” insurance carriers to bring you high-quality, affordable benefit options. Moreover, our plans are hand-selected to meet the unique needs of today’s diverse workforce—whether you're covering two lives or two hundred.

Furthermore, participants can choose from a flexible, a-la-carte menu of benefits, allowing them to select only the coverage that fits their lifestyle and budget.

🔗Read More ➤

Simplified Contracting. Streamlined Support.

7,000+ Broker Partners Nationwide

At Enrollment First, we proudly support a growing network of more than 7,000 broker partners across the country. Our goal is simple: make your job easier. Similarly, that’s why we offer a dedicated Broker Support Team to help you every step of the way—from onboarding and product training to marketing resources and sales assistance.

Additionally, with our powerful eConnect technology, you can manage your entire book of business from a single dashboard. Track leads, run reports, review commission statements, monitor client activity, and more—all in real time.

Broker Platform Highlights:

- Access a multi-carrier quoting and enrollment platform

- View enrollments by group, product, or carrier

- Track client premiums and paid-to-date status

- Run reports on open invoices, pending enrollments, and more

🔗Read More ➤

Let Us Be Your Partner for Success.

Broker Support

FROM OUR

BLOG

What’s Next in Health Coverage?

What’s Next in Health Coverage for Gig Workers and Contractors? At Enrollment First, we’re helping professionals across industries access the kind of benefits once reserved only for traditional employees. As the healthcare environment shifts, here’s how we see

Why Brokers Are Turning to eConnect to Grow Faster and Work Smarter

Why Brokers Are Turning to eConnect to Grow Faster and Work Smarter In today’s rapidly changing benefits landscape, particularly for 1099 contractors, gig workers, and small businesses, brokers require more than just a portfolio of products. Brokers

Voluntary Benefits that Sell Themselves

What Gig Workers and 1099’s Are Asking For in 2025 As the employment landscape evolves, brokers catering to the 1099 workforce need to recognize a crucial shift: gig workers are actively seeking benefits, and they have clear

ACA Compliance Isn’t Optional

What Brokers Need to Know Before It Costs Their Clients Thousands In today’s evolving benefits environment, brokers face mounting pressure to ensure their clients remain compliant with the Affordable Care Act (ACA). With workforce reforms gaining momentum

The Future of Enrollment Isn’t Face-to-Face

The Future of Enrollment Isn’t Face-to-Face: Remote Workforces Changed the Game Remember when benefit enrollment meant clipboards, break rooms, and stacks of paperwork? That era is long gone. Today’s remote, mobile, and hard-to-reach workforce has made traditional

Why Brokers Choose Enrollment First

Health Benefits Platform for Brokers Simplifying Enrollment, Boosting Retention Brokers in today’s fast-paced health benefits environment are under more pressure than ever. Clients expect more than just product recommendations—they want seamless enrollment, year-round support, and simplified compliance.

Jason A.

DIRECTOR

As our PEO began to expand into other states, we found ourselves in need of a broker that could meet our client’s ever-growing insurance needs. We found that many brokers could not keep up with our requirements or their services were cost prohibitive. Enrollment First presented a benefits business plan that overcame all obstacles, helped lessen our administrative burdens and was very cost effective. Through their partnership, we have been able to reach out to a greater number of clients and employees about the available benefits which helps in client retention and grow our benefits program. Personally, I have enjoyed our partnership with Enrollment First and would highly recommend them to any organization that has insurance needs.

Sharon G.

DIRECTOR

Enrollment First’s technology platform and Broker Support team are valuable resources for our agents. It’s rare to find a business partner that not only wants to do business with you, but will also support your team like their own. We can always count on Enrollment First to communicate with our agents and go above and beyond to assist with our clients’ needs. Whether we need agent training or a customized brochure, the Enrollment First team goes the extra mile. I highly recommend Enrollment First to any agency or independent agent looking for a long-term business partner.

Kenny P.

DIRECTOR

Our agency has partnered with Enrollment First, Inc. as our strategic business partner for over a decade for the health & wellness insurance elections for our clients. They understand the Transportation Industry and have the administrative platform to support you and the participants direct.

Find Us

Copyright © 2025 Enrollment First, Inc. All rights reserved.